Big Finance Is Going Green. Smaller Finance, Not So Much

The largest institutions have increasingly favored green stocks in recent years as small investors have done the opposite.

Big Finance Is Going Green. Smaller Finance, Not So Much

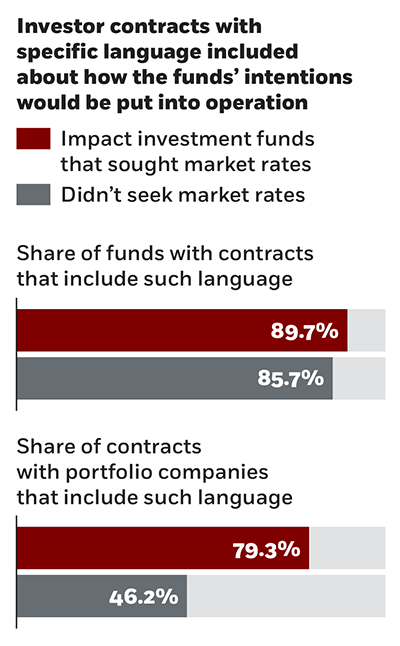

Impact investors want goals written in contracts

Christopher Geczy, Jessica S. Jeffers, David K. Musto, and Anne M. Tucker, “Contracts with Benefits: The Implementation of Impact Investing,” Working paper, April 2018.

The largest institutions have increasingly favored green stocks in recent years as small investors have done the opposite.

Big Finance Is Going Green. Smaller Finance, Not So Much

A proposed greenhouse gas emissions reporting regime exempts private companies from disclosure.

Should Private Companies Report Emissions?

Why did prices for US Treasurys drop along with stock prices in the spring of 2020?

How Financial Regulation Fed a Treasury Bond CrisisYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.