Large Language Models Can Improve Stock Market Forecasts

Analyzing both numbers and narrative context in company reports led to better price forecasts.

Large Language Models Can Improve Stock Market Forecasts

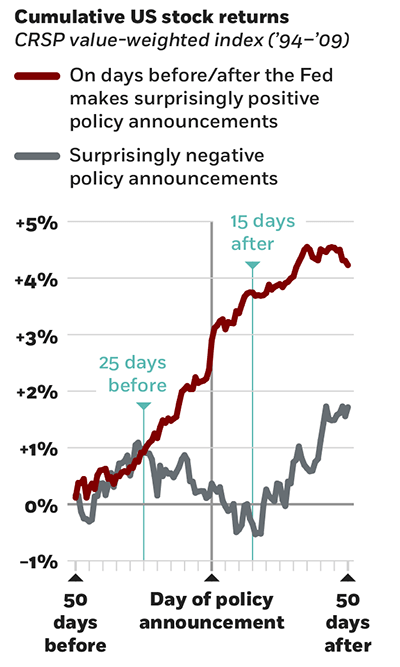

When Fed announcements don’t go as expected, momentum traders gain

Andreas Neuhierl and Michael Weber, “Monetary Momentum,” Working paper, June 2018.

Analyzing both numbers and narrative context in company reports led to better price forecasts.

Large Language Models Can Improve Stock Market Forecasts

Chicago Booth’s Raghuram G. Rajan joins hosts Bethany McLean and Luigi Zingales to explore risks in the financial system and possible solutions.

Capitalisn’t: Why the Banking Crisis Isn’t Over

Research suggests HFT winners gain billions of dollars per year at the expense of other participants in global stock markets.

How to Calculate How Much High-Frequency Trading Costs InvestorsYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.