Infographic: In China, a Loophole Allowed Insider Trades

Research highlights the need for cross-border cooperation among securities regulators.

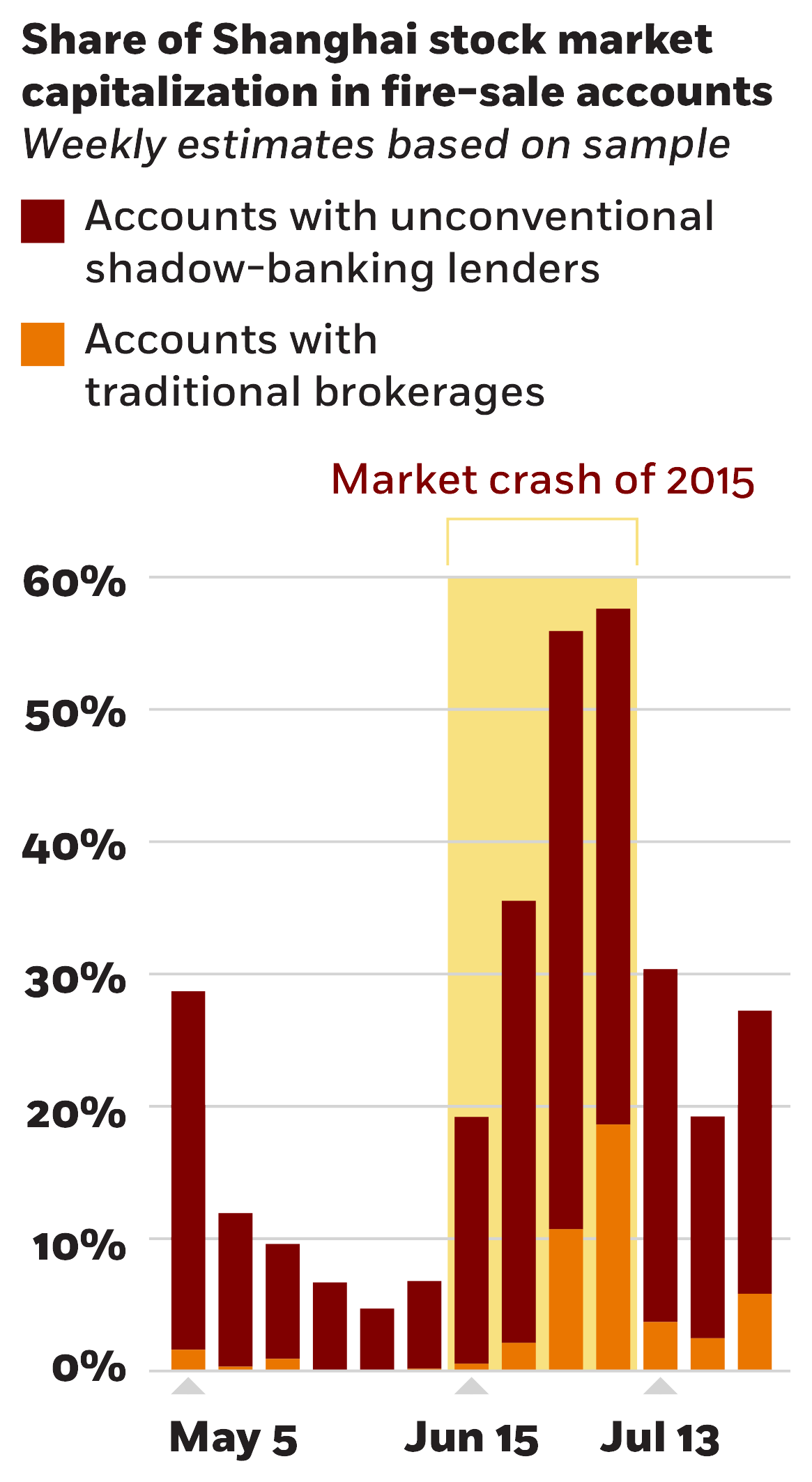

Infographic: In China, a Loophole Allowed Insider TradesHeavy borrowing contributes to stock market crashes

Jiangze Bian, Zhiguo He, Kelly Shue, and Hao Zhou, “Leverage-Induced Fire Sales and Stock Market Crashes,” Working paper, September 2018.

Research highlights the need for cross-border cooperation among securities regulators.

Infographic: In China, a Loophole Allowed Insider Trades

It’s still difficult for retail investors to exert influence on the companies in their portfolios—for now.

Can Individual Investors Make Their Voices Heard?

Capitalisn’t hosts Luigi Zingales and Bethany McLean speak with Bill Browder about how to improve the sanctions regime.

Capitalisn’t: Ukraine—Sanctioning the Oligarchs’ EnablersYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.