States that allowed banks to foreclose on delinquent homeowners without a court process experienced more foreclosures, larger drops in home prices, and bigger declines in spending.

- By

- September 02, 2014

- CBR - Economics

States that allowed banks to foreclose on delinquent homeowners without a court process experienced more foreclosures, larger drops in home prices, and bigger declines in spending.

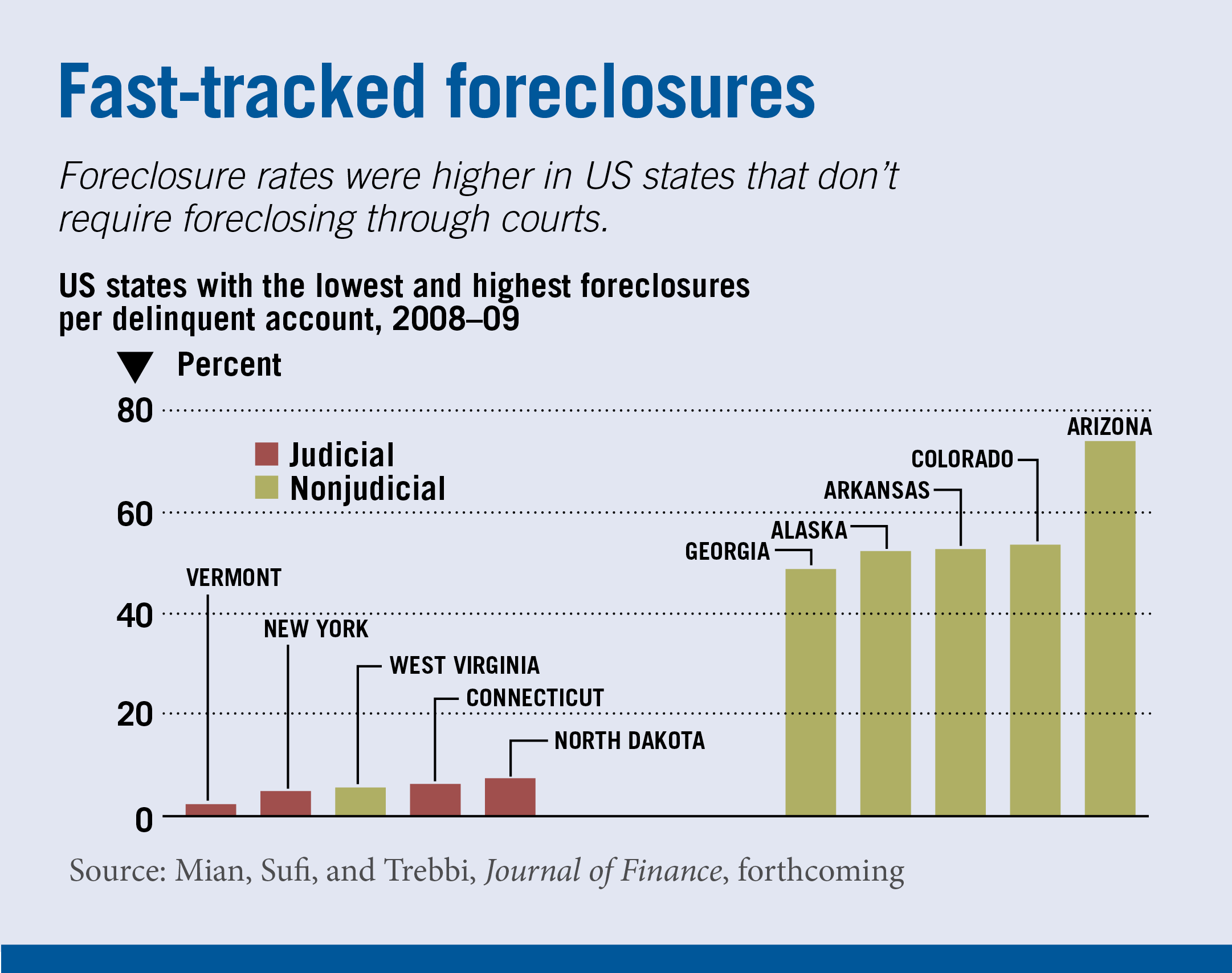

Some 21 US states allow banks to foreclose on delinquent homeowners without first suing them in court, a concession that lets lenders bypass the costlier and lengthier legal process required elsewhere. Now research finds that states endorsing such shortcuts suffered an inordinate amount of economic damage at the height of the recent recession.

The pain included far higher foreclosure rates and bigger plunges in home prices, new housing construction, and auto sales, according to a study by Professor Amir Sufi, Princeton University’s Atif Mian, and the University of British Columbia’s Francesco Trebbi. But the researchers also find some evidence that the more-beaten-down states experienced stronger recoveries as foreclosure rates declined nationwide.

The stark differences in fortunes between these judicial- and nonjudicial-foreclosure states allowed the team to measure the economic damage inflicted by home foreclosures, using data from 2008 to the end of 2012. Previously, economists struggled to isolate and measure independently the macroeconomic damage caused by any specific financial friction such as a credit crunch, high unemployment, or institutional failures.

The researchers find that foreclosures exacerbated the recent recession by fueling a broader economic decline early on. Home-foreclosure rates skyrocketed in the early days of the financial crisis and peaked in 2010. Housing prices dropped 10%–20% nationwide between 2007 and 2009. Residential investment (as defined by new housing-construction permits issued) dropped 80%, and auto sales dropped 41%. The researchers conclude that foreclosures caused 33% of the decline in house prices, 20% of the decline in residential investment, and 20% of the decline in auto sales.

Separating home-foreclosure data by judicial- and nonjudicial-foreclosure states proved key to teasing out the relationship between this wave of repossessions and the deterioration of the broader economy. States allowing nonjudicial foreclosures consistently reported higher foreclosure rates. But the researchers find that foreclosure rates were the only significantly different variable between judicial- and nonjudicial-foreclosure states.

However, delinquent homeowners in nonjudicial-foreclosure states were twice as likely as their counterparts in other states to experience foreclosure. And higher foreclosure rates were accompanied by much larger drops in home prices. By one measure, house prices in nonjudicial-foreclosure states fell by 43% from the middle of 2006 to the beginning of 2009, versus only 28% in states requiring a court process.

Moreover residential investment dropped significantly more in nonjudicial states from 2007 to 2008, and that activity remained significantly lower in 2009. Auto sales were 5%-–10% lower in nonjudicial- versus judicial-foreclosure states between 2008 and 2011.

The number of US foreclosures declined dramatically in 2011 and returned to precrisis levels by the end of 2013. The research suggests that states with the higher foreclosure rates early on experienced stronger recoveries by some measures. Home prices in recovery years spiked higher in nonjudicial-foreclosure states than in judicial-foreclosure states. By 2012, the two groups were reporting roughly equivalent five-year home-price gains. Auto sales showed a slightly bigger rebound in nonjudicial states. Statistically, there was little difference in residential investment between the two groups during that time.

The authors warn that the data during this recovery period is less conclusive. But the results tentatively imply little advantage to speeding up the foreclosure process. During an economic recession, spreading out the pain over time might make the worst of times a little less bad.

Atif Mian, Amir Sufi, and Francesco Trebbi, “Foreclosures, House Prices, and the Real Economy,” Journal of Finance, forthcoming. Chart reprinted with permission from Wiley. Copyright 2014.

Chicago Booth’s Sendhil Mullainathan visits the podcast to discuss if AI is really “intelligent” and whether a profit motive is always bad.

Capitalisn’t: Who Controls AI?

Should the government and insurance companies subsidize travel to healthcare centers?

Why Medical Tourism Could Be Good Policy

Chicago Booth’s Chang-Tai Hsieh discusses China’s economy with the Capitalisn’t podcast.

Capitalisn’t: The End of China’s Miracle?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.