A Better Way for Finance (and Others) to Handle Missing Data

As much as we’re awash in data, a huge problem for building predictive models is the information we don’t have.

A Better Way for Finance (and Others) to Handle Missing DataThe annual Berkshire Hathaway meeting, dubbed the “Woodstock of capitalism,” draws about 40,000 fans and shareholders of legendary value investor Warren Buffett, himself inspired by the late Benjamin Graham, the godfather of value investing.

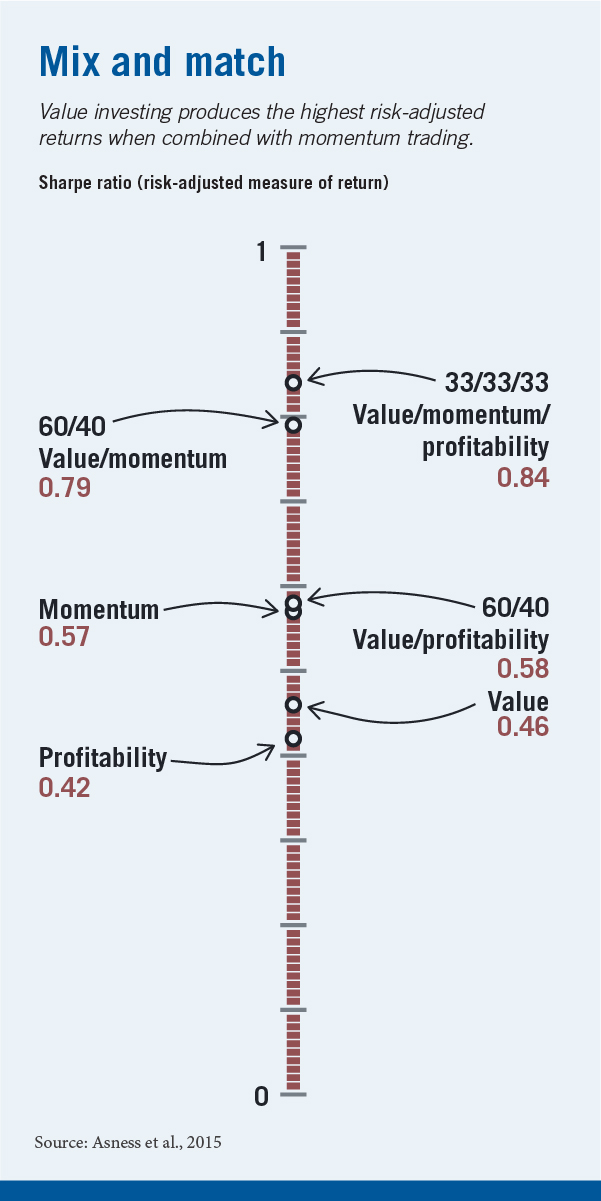

But what does value investing really mean? The basic idea is that stocks that are trading at low prices to their fundamental or intrinsic values outperform expensive stocks in the long run. Despite being scrutinized by academics for more than 30 years, the strategy is still misunderstood, argue Clifford S. Asness, Andrea Frazzini, and Ronen Israel, of AQR Capital Management, and Tobias J. Moskowitz of Chicago Booth. Using publicly available data on US equities markets, the researchers find that value investing works most effectively with other strategies to reduce risk and increase portfolio returns.

Clifford S. Asness, Andrea Frazzini, Ronen Israel, and Tobias J. Moskowitz, “Fact, Fiction, and Value Investing,” Working paper, April 2015.

As much as we’re awash in data, a huge problem for building predictive models is the information we don’t have.

A Better Way for Finance (and Others) to Handle Missing Data

How shareholders can maximize their social impact

Green Investors: Don’t Divest . . . Protest!

When investors receive dividends, they often use the cash to buy more shares of stock—and not necessarily of the company that issued the dividend.

Dividend Payouts Lead to Stock-Price BumpsYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.