The Case for and against Central Bankers

Monetary policy makers set the stage for inflation but were slow to respond when it appeared.

The Case for and against Central Bankers

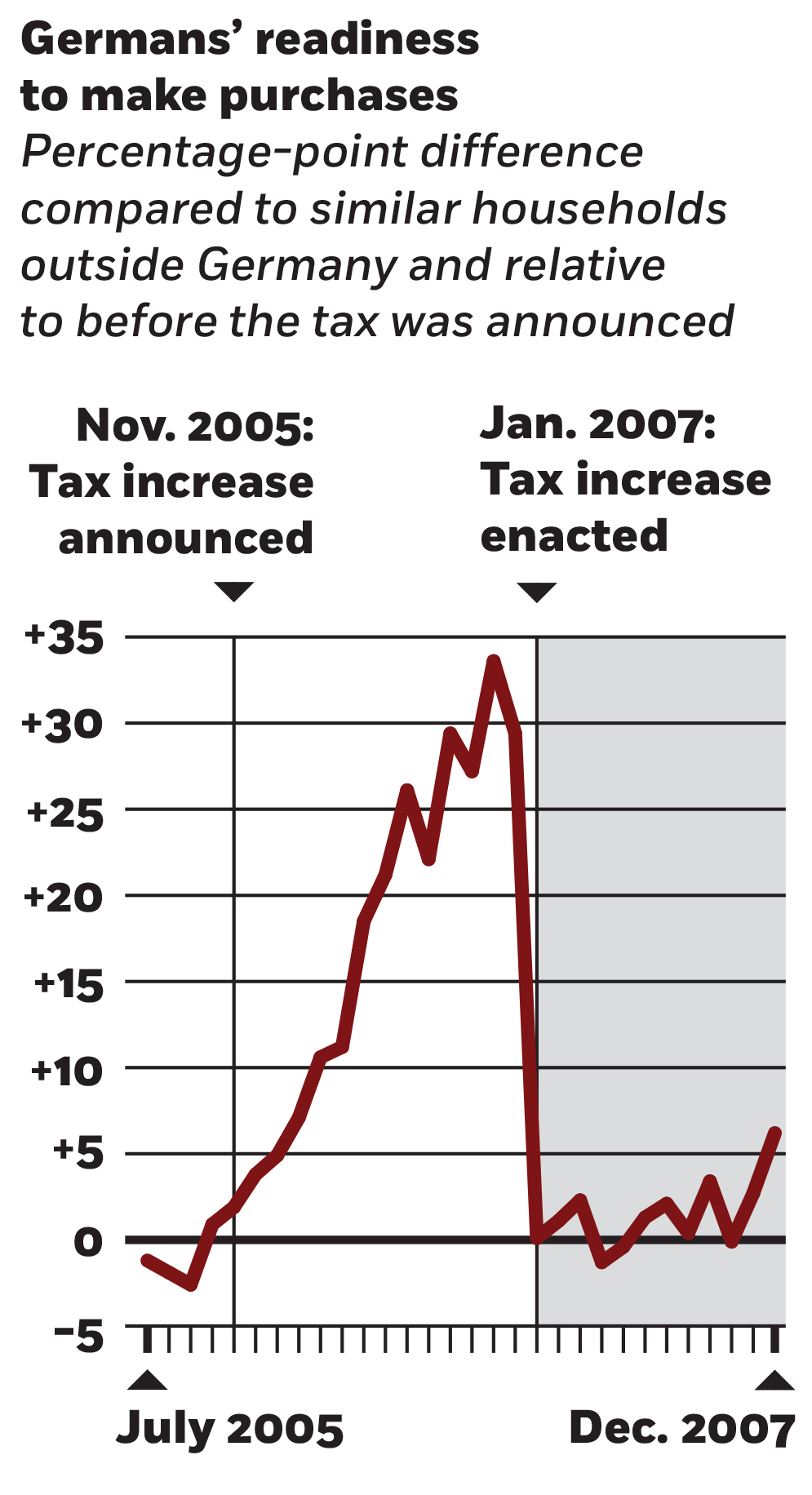

How announcing a sales-tax hike could boost consumer spending

Francesco D’Acunto, Daniel Hoang, and Michael Weber, “The Effect of Unconventional Fiscal Policy on Consumption Expenditure,” Working paper, August 2016.

Monetary policy makers set the stage for inflation but were slow to respond when it appeared.

The Case for and against Central Bankers

UCLA’s Sebastian Edwards joins Bethany McLean and Luigi Zingales to discuss the implementation of market-oriented policies in Chile.

Capitalisn’t: Key Lessons from the ‘Chicago Boys’ Chile Experiment

Economic history hints at how migration induced by climate change might differ from that caused by other forces.

What Can the 1930s Tell Us about the Coming Climate Migration?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.